Nigeria’s Energy Transition Plan emphasizes five objectives including lifting 100 million citizens out of poverty, providing modern energy services to all, managing job losses from the oil sector, harmonizing all ETP initiatives and promoting fair, inclusive and equitable transition for the African continent. The Plan which is lacking in how technological, financial, and human resource gaps will be filled prioritizes decarbonizing five sectors—power generation, oil and gas extraction, cooking, industry, and transport—and positions gas as the main fuel for electricity generation.

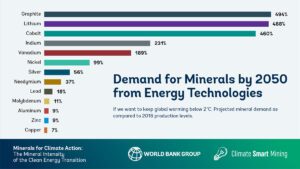

Mining sectors across the globe are faced with increased pressure as demand for transition minerals (graphite, lithium, cobalt, indium, vanadium, nickel, silver, and others) soars. The strain on mining communities will be extremely intense and Nigeria’s strategic role in Africa means the country must provide required leadership in shaping the policy environment for its mining sector to avert the ‘resource curse’ that characterized the oil boom era.

As we consider the ‘just’ in the Energy Transition operations to accommodate communities that hosts extractive projects and activities with a view to ensuring increased benefits especially in addressing rising youth unemployment, widening inequality, environmental degradation, lack of social infrastructure and increasing risk to livelihoods, it is pertinent to reflect on the impact of artisanal and small scale mining activities to mobilizing needed revenue through taxes and royalties for development as well as the availability of critical minerals to execute Nigeria’s energy transition plan to address the climate crisis and achieve carbon neutrality by 2060.

In Nigeria, artisanal and small-scale mining operations accounts for about 80% of mining activities in the industry and in 2019, 1,579 artisanal mining sites were discovered with hundreds of thousands of miners many of whom fail to pay taxes and royalties to government on minerals extracted. Also, Nigeria loses about $9billion annually to illegal mining and smuggling of gold.

For mining communities to benefit maximally from extractive activities not just in Nigeria but across all resource rich countries especially developing nations, it is important to ensure communities can track revenue inflows from the sector and monitor expenditure outflows especially for development priorities through budget, procurement, and audit instruments.

The mining sector in Nigeria must be repositioned to meet up with the rising pressure for energy transition minerals as well as the need to adequately diversify the Nigerian economy away from fossil fuel. To take advantage of the vast potential of the sector and drive contribution to GDP beyond the current 0.3%, it is vital for the government to address numerous challenges for artisanal and small-scale mining among which are: insufficient sensitization on safety risks, environmental impact, access to credit, cumbersome process in acquiring small scale mining lease and limited awareness on health hazards.

While there are several best practices to improve the sector for increased revenue and better standards for artisanal and small-scale mining operations, the Nigerian government could consider: phasing requirements for registration, decentralizing the market for mined products, raising awareness of chemical toxicity and alternatives, and technological advancement to address technical constraints.

The mining sector in Nigeria can indeed contribute more than it currently does to the country’s revenue profile and development of host communities. This is evident by the 25% increase in revenue projection in the 2023 budget signed by President Muhammadu Buhari in which Nigeria expected to raise N3.64billion as against N2.92billion projected in 2022. Some quick policy wins for the government would be to accelerate review of the Minerals and Mining Act of 2007 as well as the Minerals and Mining Regulations of 2011 to improve the operational environment for artisanal and small-scale mining while integrating artisanal mining policy into the country’s social safety programs.

Holistically, the Nigerian government must consider these 10 policy ideas to mobilize mining revenues detailed in the handbook on the future of resource taxation jointly put together by the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF) and the African Tax Administration Forum (ATAF).

As public policies are largely shaped by corporate objectives, it has become imperative to continue to assess the commitment of the corporate constituency to a well-managed and just energy transition. While it is urgent to decarbonize, it is also crucial to make available information about how oil and gas companies are planning for the energy transition and making decisions about which projects to develop. This will enable policymakers, citizens in petroleum-rich countries, advocates, and investors to navigate the energy transition pathway effectively and in an informed manner.

To ensure policymakers, civil society, and communities are able to determine the risks they face as implementation of Nigeria’s energy transition plan gathers momentum, the disclosure requirements contained in the Publish Your Plans handbook developed by the Publish What You Pay-United States (PWYP-US) and its allies provides the needed support on what information to demand from oil and gas corporations to curb information asymmetry that rigs energy transition activities against the government and its people. The seven recommendations discussed in the handbook represent the kinds of information that are essential for oil and gas companies to disclose publicly to demonstrate their ability to effectively manage climate related risks and esnure a just energy transition for Nigeria.

Join us at PLSI as we continue to push the boundary of accountability further!

Written by:

Olusegun Elemo – Executive Director at PLSI